Securitisation and the expanded complexity of the real estate business have prompted better approaches to repackage property resources for make a more extensive menu of venture potential open doors. Nonetheless, the gamble, return and liquidity ascribes of these ventures fluctuate enormously

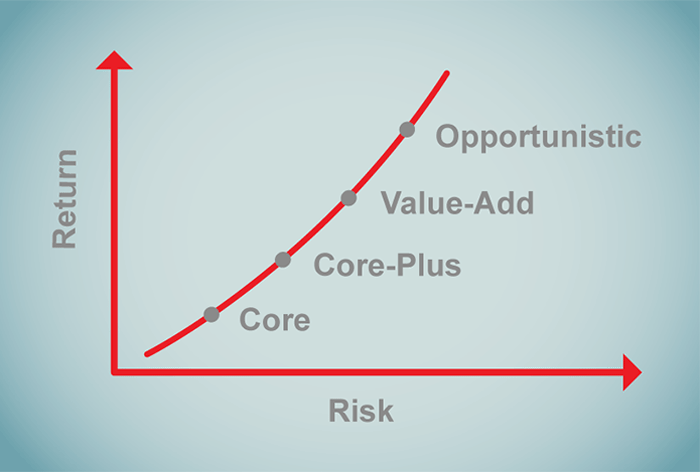

This paper gives an outline of various real estate speculation methodologies in light of three gamble return styles (center, esteem added and sharp) and four quadrants of real estate money management, in view of whether they are value or obligation and exchanged people in general (recorded) or confidential business sectors.

Risk – return styles

Figure 1 shows three key gamble return styles for real estate investing: center, esteem added and artful.

Center real estate investing is purchasing resources that are all around found, rented to quality inhabitants and subsidized with unassuming degrees of influence. Such speculations normally target 9%-12% p.a. all out gets back with the goal of giving financial backers secure pay in addition to humble capital appreciation. The pay part normally addresses a critical larger part (around 70%) of the normal all out return. Instances of center speculations incorporate CBD places of business, shopping malls and modern stockrooms.

The capacity to fundamentally improve the worth of center real estate is restricted contrasted with esteem added and shrewd venture techniques. Center resources for the most part require practically no momentary capital consumption other than typical fixes and upkeep.

In any case, center financial planning doesn't mean detached administration. Dynamic administration of center resources can add esteem through drives, for example, further developing lease profiles and lessening building working expenses. Center real estate will in general be held as long as possible, normally five years or more. Influence is by and large underneath half.

As of late, real estate related social foundation, for example, kid care focuses, clinical focuses and understudy convenience have progressively been considered as genuine center speculations. There are both recorded and unlisted real estate finances zeroing in explicitly on these areas, for example, the Folkestone Schooling Trust, the Age Medical services REIT and the unlisted Australian Solidarity Medical services Asset.

Esteem added putting participates in dynamic procedures to make esteem in the fundamental real estate speculations through repair, re-improvement or renting up of empty space. A worth added technique commonly targets 'optional' resources which because of multiple factors have discouraged degrees of pay or the worth has decayed after some time comparative with the more extensive market. Through hands on 'dynamic administration' there is an emphasis on expanding a resource's pay and thus capital worth. Esteem added real estate speculations will thusly speak to financial backers looking for upgraded returns in return for more significant levels of resource working gamble. These speculations target returns between 10%-15% p.a. also, regularly utilize unobtrusive to elevated degrees of influence of somewhere in the range of 30% and 70%. They have a hold time of somewhere in the range of three and seven years, albeit frequently at the more limited end, asthe effective execution of the system will rely upon picking the ideal opportunity in the real estate cycle to take advantage of the open door.

Crafty money management focuses on a scope of higher gamble methodologies, for example, real estate improvement, profoundly utilized supporting or exchanges including 'circle back' potential (frequently known as bothered financial planning), ventures with convoluted monetary designs (counting mezzanine obligation) or developing business sector speculations. The emphasis is on capital appreciation, with the profits commonly back-finished and accomplished through a deal or culmination of a turn of events, frequently with little pay en route.

Such systems normally utilize more elevated levels of influence somewhere in the range of half and 80% and ordinarily target returns of 15% p.a. additionally.

Artful procedures require specific speculation and the board aptitude because of their intricacy and to alleviate the higher gamble. Financial backers will generally be complex and very much promoted with a higher gamble hunger than center or worth added financial backers. Deft money management takes a gander at moderately momentary hold periods, by and large under three years. The key is to speedily leave the speculation as the technique is executed and esteem amplified.

Esteem added and artful financial planning isn't just the utilization of elevated degrees of influence. They require cautious examination of the real estate cycle and market patterns to exploit disengagements and mispricing on the lookout.

Four quadrant investing

Four quadrant contributing alludes to the grouping of real estate investing across four monetary business sectors - public and private, obligation and value - as displayed in Figure 2.

The most widely recognized types of private market in Australia, other than straightforwardly claiming a structure, are unlisted real estate reserves or unlisted organizations which normally own one resource, for example, a place of business or shopping complex and have a decent term of somewhere in the range of five and seven years. These speculations are exchanged the confidential market, and among buy and deal, values are gotten from private valuations. Such resources are moderately illiquid contrasted and the public business sectors.

Public value alludes to interests in real estate speculation trusts (A-REITs) or real estate organizations whose protections or offers are exchanged on a stock trade like the ASX. The A-REIT market is the most fluid and straightforward of the four quadrant markets, and presently contains 50 A-REITs with a market capitalisation in overabundance of $97 billion. There are another 29 real estate related protections that are ordered by S&P/ASX as real estate chiefs and engineers.

Confidential obligation addresses interests in direct real estate advances or in reserves that hold contracts on real estate, for example, contract trusts. The credits perhaps first home loans (senior obligation) or second positioning subjected advances, for example, mezzanine credits. Normally, the financial backer or moneylender will get occasional premium installments from the borrower and a security charge against the property as a home loan. Toward the finish of the home loan term, the financial backer or bank will get the equilibrium of the home loan head. This kind of real estate putting is like putting resources into bonds that are held to development.

Public obligation addresses real estate obligation instruments like business contract back protections (CMBS) which are exchanged the public market or debt without collateral (corporate securities) gave by A-REITs ad real estate organizations. Admittance to putting resources into the public real estate obligation market in Australia is solely restricted to institutional or 'discount' financial backers.

The four quadrant model of investing underlines the connections between real estate and the capital business sectors. The pay from every one of these ventures depends on the presentation of the basic real estate regardless of the way that the evaluating, the gamble and the liquidity will rely upon what part of the range (obligation or value) the speculation happens and whether it is exchanged people in general or confidential market.

Conclusion

While the menu of real estate speculation open doors has expanded, not all venture styles and methodologies across the four quadrants are reasonable for all financial backers. Most financial backers in real estate will zero in on center real estate systems and will regularly put resources into the quadrant that best suits their liquidity prerequisites. In the event that liquidity is a significant variable, an interest in open value, for example, A-REITs might be a more suitable speculation elective than private real estate either straightforwardly or through an unlisted asset or partner.

Given the various business sectors and hazard profiles, valuing peculiarities in the present moment might happen across the three speculation styles and four quadrants. A more modern financial backer might exploit these valuing exchanges and get across the three styles or designate between the four quadrants as per where they hope to accomplish the best relative gamble changed returns at various places in the real estate cycle.