A speculation methodology is a characterized way to deal with financial planning that shapes the decisions a financial backer makes for their portfolio. Different speculation methodologies expect explicit strategies in view of crucial convictions. For example, esteem effective money management looks for stocks that are underestimated and are selling for not exactly their actual worth, though development putting expects to find speculation open doors in organizations that have a high potential for development. This guide will separate the significant venture techniques and assist you with concluding which of them is probably going to be a decent decision for you. You can likewise work with a monetary guide to assist with making the right resource designation for your portfolio.

How to Choose an Investment Strategy?

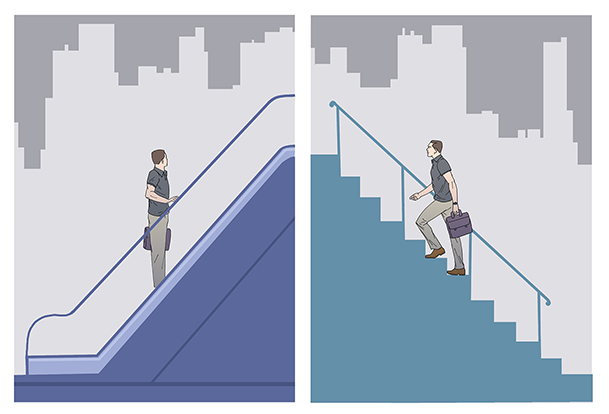

There are various variables that go into picking the speculation methodology that will turn out best for you. One thing is to contemplate whether you need to pick a functioning or aloof money management system. Dynamic money management includes the regular trading of stocks. It requires involved administration, frequently by a portfolio chief who can dig into different variables to conjecture the market.

Latent methodologies, then again, are centered around purchasing and holding ventures for the long stretch. Defenders of detached systems contend this reduces down on exchanging expenses and increments charge effectiveness. It additionally will in general be safer than market-timing systems, which can receive huge benefits by attempting to beat the market yet additionally experience large misfortunes. Generally, portfolios will mix dynamic and inactive financial planning.

Different elements you want to consider are your time skyline, for example, that you are so near significant life altering situations like purchasing a house, having kids or resigning. On the off chance that you want pay soon, you probably shouldn't choose long haul speculations, for example. Your gamble resilience is another thought. For the most part, you can endure more gamble from the get-go in your vocation, and want safer, more steady speculations as you push toward retirement. A methodology like pay effective money management, which depends on creating a consistent pay, may be safer than a more emotional system like worth financial planning.

1. Growth Investing

Development contributing is a venture procedure that spotlights on building capital through purchasing values that can possibly increment in esteem. This is most normally found in stocks where financial backers trust the worth of the organization, and subsequently the worth of the offers they've bought, is probably going to go up.

Development contributing contains a few sub-systems. Two of the most well-known are transient ventures and long haul speculations. Present moment for the most part implies purchasing stocks and holding them for under a year. Financial backers utilize momentary development ventures when they think an organization's worth is probably going to shoot up rapidly. Long haul ventures, then again, are held for over a year. Financial backers utilize these when they accept the organization's worth will develop gradually and consistently throughout the long term.

2. Value Investing

Esteem effective financial planning, a speculation system advocated by Warren Buffett, centers around searching out stocks that you accept are inherently underestimated. By finding organizations the market doesn't as expected esteem, financial backers can possibly post large gains when the market in the long run amends and the organization becomes esteemed appropriately. This is an exceptionally emotional kind of money management.

3. Income Investing

Pay money management centers around creating a consistent pay from your ventures. As opposed to looking for stocks that will fill in worth and give your portfolio more speculative worth yet make you no more extravagant as far as money, pay effective financial planning needs to find ventures where your portfolio sees genuine worth as cash in your pocket.

Pay ventures by and large take two structures. The first is stocks that deliver profits. A few organizations pay their financial backers a level of benefits as a profit. That is cash that goes into your record assuming you own stock. The other speculation normal to pay effective money management is securities, which pay out on a predictable premise.

4. Socially Responsible Investing

The past speculation methodologies center all the more so around how a financial backer brings in cash. This putting system is a cycle different in that it investigates what your speculation can mean for the world at large, beyond your portfolio.

You can fit a socially dependable money management system to what you by and by care about with regards to social obligation. Assuming you are a naturalist, for example, you could put vigorously in green organizations and try not to put resources into organizations that arrangement in non-renewable energy sources. Assuming you care about international strategy, you could keep away from organizations that carry on with work in specific nations.

Halal financial planning — contributing done following Islamic standards — is one more type of socially cognizant money management. This implies, in addition to other things, not putting resources into organizations that arrangement in liquor, betting or pork items.

5. Small Cap Investing

Little cap effective money management centers around organizations with a market cap — that is complete worth — between $250 million and $2 billion. This implies you don't put resources into the organizations that numerous financial backers center around (think Apple, Passage, IBM, and so on) and on second thought in more modest organizations you think could do well from now on.

Little cap organizations frequently have not many offers accessible for public buy. Since institutional financial backers by and large would rather not own too enormous of a level of an organization, they could avoid the organizations, giving individual financial backers an advantage.

6. Buy-and-Hold Investing

A purchase and-hold speculation methodology includes finding ventures that are probably going to perform above and beyond quite a long while. In any event, when the market plunges this procedure utilizes the mindset of continuing through to the end and accepting that the ventures will have a positive return long term. In the event that this is an ideal procedure for you, you'll be less stressed over the transient effect available as the conviction is that the market performs above and beyond a time of quite a while.

7. Active Investing

Dynamic money management is vastly different than purchase and-hold as it centers around riding the recurring patterns of the market, making a lot. more incessant exchanges. It tends to be extremely challenging to dissect the market successfully and dynamic financial backers utilize various procedures to do exactly that. They center around anything from exchanging in view of occasions to setting up everyday specialized examination to track down possible speedy returns.

The Bottom Line

There is no simple method for picking which contributing technique you ought to pick while building your own portfolio. You could wind up with a blend of sorts as you find that the right technique for you includes different kinds of speculation procedures. The most effective way to pick a money management methodology is to ponder your monetary and individual objectives. Then, at that point, sort out which methodology is probably going to assist you with accomplishing those objectives. You can likewise enroll the assistance of a monetary guide.