[Editor’s Note: Below is the full text of our 239th Weekly Transmission, originally delivered uncontrived to the inbox of increasingly than 600 GEM members on January 4th, 2023.]

For two straight years our central prediction theme was climate (2021 version). The importance of climate hasn’t lessened in 2023. In fact, the impact of the Inflation Reduction Act will reverberate for years to come.

For two straight years our central prediction theme was climate (2021 version). The importance of climate hasn’t lessened in 2023. In fact, the impact of the Inflation Reduction Act will reverberate for years to come.That said, we’re going when to the nuts in 2023: profits rule and negative unit economics drool.

When wanted was nearly self-ruling for corporations, products and services not feasible in normal environments became feasible. Well, the music has stopped and the chickens have come home to roost. Unprofitable companies can no longer hibernate overdue a “grow at all costs” directorate.

Bryan Copley is a firm believer the tortoise will be sexier than the hare this year:

The Fed will protract to grind the gears of economic growth, and the unseemly wanted financing meteoric startup growth for companies without a plausible path to profitability has zestless up faster than the Los Angeles River. The age of unseemly growth is a yesterday age; growth in 2023 and vastitude will be earned, not bought.

Imagine startups are race cars and interest rates are gas prices. When gas is unseemly and it’s a stilt race to the SPAC that takes you public, velocity is all that matters. Now that gas is expensive and the finish line remoter away, velocity takes a when seat to gas mileage. For the first time in a long time, the tortoise is sexier than the hare.

Startups shouldn’t optimize to meet Warren Buffet’s standards for visitor profitability. Buffett invests mostly in de-risked, low start companies with mature, stabilized mazuma flows. VCs rummage the earth for upper start opportunities where they can take calculated, well-matured risks on companies with unsymmetrical upside potential.

Today, as in the yesterday age of unseemly growth, startups and investors unwrinkled will protract to take and embrace risk. Like KPCB cofounder Tom Perkins said:

‘If there is no risk, you have once missed the boat.’

But in 2023, squint for startups to uncork architecting slower, steadier, increasingly sustainable growth models that yield increasingly capital-efficiency—perhaps plane profits!—prior to an IPO.

The return of merchantry pragmatism. Fighting tooth and nail to put every dollar in the bank, day without day, month without month. 2023 will be a year that perseverance, grit, and belly-to-belly gainsay on the merchantry battleground wins.

-DM

Below, GEM members share a range of interesting trends and predictions for 2023.

PROPTECH TRENDS

GENERATIVE AI ONSLAUGHT

Drew Meyers // Founder, Geek Estate

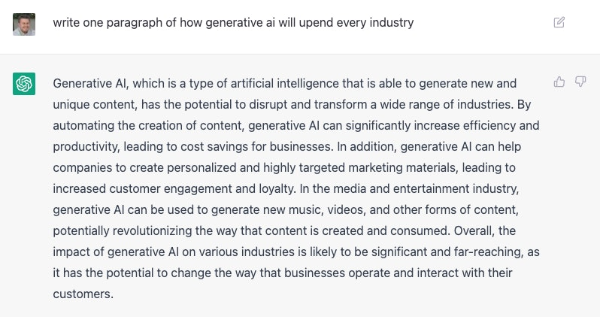

My services are no longer required. Let’s put GEM on autopilot and we can all learn from the bots.

In all seriousness, the ramifications of what’s coming from OpenAI’s ChatGPT and others are vastitude immense. The speed of progress with this technology is like nothing we’ve overly seen. Likening it to a locomotive with no brakes would be an understatement.

Writing listing descriptions will wilt an art of the past. Conversational consumer service and sales bots will unquestionably wilt tolerable. Perhaps, dare I say, interesting. Social media content writers and graphic designers will be in search of new revenue streams. Home buyers will be provided a personal teammate that talks their language, and has wangle to their financial and home browsing data.

Some say video will stave extinction the way other content will not. But, if Morgan Freeman’s deepfake and Val Kilmer’s inveigling AI voice are any indication, we’re in trouble:

Endless upstanding questions upspring when there are few, if any, lines between real and fake. We’ll constantly debate the implications of synthetic reality, and we will both mistiness and grossly navigate many lines that once specified reality and work up until now.

On the plus side, the value of thoughtful curation and expert wringer will increase in value as the internet turns into a drain of auto-created, time-wasting marketing copy.

POWER OF THE MACHINES

Dave Garland // Partner, Second Century Ventures

We are in the midst of one of the most profound cultural evolutions in human history. Breakthrough technology in robotics and AI, powered by algorithms and mounting data sets, will hoist humanity to new heights. 2023 will be a BIG year for machine-based enhancements. What does this midpoint for real estate? We can expect a tale of juxtapositions:

- Peak AI?: We will see GPT4 in the spring. Combined with incredible new generative AI applications in text, image, and video, human creativity will be challenged to expand its horizons by computer-based creativity. But real manor practitioners will not likely prefer this new tech en masse. Rather, we can expect to see improvements within existing systems (i.e. transaction management, CRM, B2C advertising) that leverage AI for incremental forfeit savings in a period where transactions are in ripen YoY. (Look to companies like Notarize, Plunk, and Evocalize for clues.)

- Intersectionality: Growing data sets will yield increasingly visualization engines to automate ramified tasks wideness industries and segments. For real estate, this ways emerging technologies can largest integrate brokerage with lending, title, insurance, and all settlement services for a increasingly streamlined, digitized consumer wits (ideally at a lower cost). (Look to companies like CRETelligent, Transactly, HouseCanary and Obie to lead the way here)

- Affordability: The three killer ‘i’s of 2022 (interest rates, inflation, and inventory constraints) will put a heightened focus on affordability in 2023 as consumers virtually the globe are presented with a growing personnel of financial products to pericope increasingly probity from an existing asset, or help procure an windfall in a period of growing credit constraints. Squint for increasingly lanugo payment assistance, probity release, fractionalization, and private probity placements to collide with traditional bank-based underwriting models in effort to help write this growing global concern. (Look to companies like Landis, Fractional, Matrix, and FutureRent for leadership in this space.)

NEW FORMS OF OWNERSHIP DEMONSTRATE MOMENTUM

David Bluhm // Co-founder, Plunk

Companies like Arrived, Fractional, Here, Flock Homes, and Rook Wanted light new paths towards rhadamanthine a real manor investor for as little as $10 and 10 minutes. The worthiness to wilt a rental property owner without the traditional hurdles of time and money is a game changer toward making real manor ownership increasingly wieldy to everyone. The ownership revolution is the future, and the pace is accelerating.

OPENDOOR OPENS THE DOOR TO A NEW NATIONAL MLS

Robert Hahn // Partner, 7DS Associates

Opendoor launched its Opendoor Exclusives marketplace, which allows sellers to connect directly with buyers in several markets without the use of traditional real manor agents. Part of the company’s 3P Platform, the marketplace includes an e-commerce wits for ownership an Opendoor-owned home.

Opendoor is outright telling everybody that it intends to get rid of both real manor teachers and “traditional listings.” No MLS or REALTOR Association can let that stand. Plus, under the rules today, Opendoor Exclusives—whether 1P or 3P—end up on Zillow’s second tab.

That ways Opendoor will be forced into rhadamanthine an MLS, increasingly or less. It won’t unquestionably be an MLS in the traditional sense, just like the Customer-Owned Exclusive is not a “listing” in the traditional sense. It’s not as if teachers can enter listings into the Opendoor 3P Marketplace and get credit, cooperation, or compensation. But it will be an MLS for the purpose of getting Opendoor properties onto Zillow, Homes.com, and other portals. Longer version on Notorious ROB.

ADOPTION OF SUSTAINABILITY PRACTICES

Jonathan Klein // Founder, GoProptech

With the global accent on strengthening ESG principles for growth and operations, the real manor technology industry will slide the integration of sustainability practices in 2023. Due to reliance on the efficiency of materials, energy, time, and money, sustainability is not limited to the environment. Advanced 3D technologies—including BIM, real-time 3D visualization, 3D printing, 3D renderings, and AR/VR—will enable the design, creation, prefabrication, and photorealistic representation of sustainable and untried 3D models. Digital twins will remoter contribute to towers resilience, fostering decarbonization, optimizing work environments, and enhancing every decision-making phase, from concept, design, and construction through to operation. Vastitude the environmental benefits, real-time visualization technology will vamp a new generation of architects and designers, who will create enticing buildings for investors, buyers, leaseholders, and stakeholders. 3D visualization may very well be the remedy tonic for a sagging 2023 real manor market.

A BOON FOR FLAGSHIP TRAVEL DESTINATIONS

Wes Walker // CEO & Co-founder, Propersum

The current Effective Federal Funds Rate (EFFR) upward march, combined with increased media sustentation on household finances, will result in unstipulated travel accommodations traffic funneling heavier to legacy, flagship destination markets ( the Outer Banks, Orlando, Napa, Vail, Tahoe, Ozarks, NOLA, etc.) where consumers finger less “experience risk”. Notable negative impacts will occur in secondary travel markets (i.e., Airbnb markets) with lattermost impacts on tertiary areas ( “middle-of-nowhere” Airbnbs). Both secondary travel markets and tertiary areas were artificially pumped from COVID lockdown escapism and the expansion of remote work adoption, and both will wits market corrections in 2023. Luxury real estate, although typically most impacted by EFFR and Quantitative Tightening compared with standard homes, will manage fairly well in legacy, flagship destination markets as traveler density, and therefore supporting rental income, cycles when from secondary markets and tertiary areas.

HOMERENTERSHIP REALITY SHOWS

Vin Vomero // Co-founder, FoxyAI

The erosion of the single greatest suburbanite of wealth for Americans—homeownership—should be a major snooping for everyone. Wealth growth from a home is largely attributed to home value appreciation and not from making mortgage payments to pay lanugo the balance.

What happens when this piggy wall no longer exists? What happens when this wealth is diverted to—and increasingly well-matured on—Wall Street due to a growing trend in Single Family Rentals (SFR) and the emerging build-to-rent trend?

There are many macro factors to consider in the movement yonder from homeownership to “homerentership,” and 2023 is poised to be a difficult year for home ownership with the unfurled growth of interest rates, low supply, and rising inflation.

VENTURE COOLDOWN IN EFFECT

Kunal Lunawat // Partner, Agya Ventures

We are moving yonder from an era where wanted was plenty and diligence was absent. Total wanted deployed in venture was $300 billion in 2020, $630 billion in 2021, and is projected to be $439 billion in 2022. The 2023 numbers might reflect a greater reversion to the midpoint mapping to the pre-pandemic era. That’s a good thing for serious entrepreneurs and career venture wanted investors.

Higher forfeit of wanted and a sharp pullback in high-growth technology stocks have distinctly impacted valuations of privately held, late-stage technology companies. The lineage of unicorns is one metric to gauge hype surrounding late-stage valuations. There are 1,192 unicorns in the world today: 136 were born in Q3 ‘21. The number declined to 25 in Q3 ‘22. This could partially be attributed to smaller round sizes, but the worthier picture is clear: companies need to earn their markups.

Sarah Liu // Partner, Fifth Wall

2023 will see significant consolidation wideness proptech start-ups as many of the companies that were worldly-wise to raise during the surplusage of 2021, will find far fewer takers when they go when out to market. Sectors that were expressly saturated such as construction site monitoring and sensor tech, as well as sectors that are seeing an outsized impact from higher interest rates (i.e., mortgage and residential closing), will be the hardest hit. Those that survive will be the ones who generate the strongest measurable consumer ROI, ideally in a short (i.e., months not years) time frame.

CLOSING THE SPIGOT OF HOME EQUITY TAPPING

Matt Michalski // Co-founder, Aryeo

Now that wanted is no longer self-ruling and real manor markets are no longer full of huge probity gains, startups helping homeowners tap into their home probity will see a major cooling-off period. The number of options misogynist in the market will subtract substantially, but no one dominant gravity will sally victorious.

STR NUCLEAR WINTER BEGINS

Brad Hargreaves // Founder & Chairman, Common

Oversupply and demand wrinkle are combining to make 2023 a very, very difficult year for the short-term rental business.

First, let’s start on the supply side. Airbnb listings are up 23% year-over-year with over 80,000 new listings coming on to Airbnb per month this past summer. Compounding the problem, a large portion of the new supply is investor-owned, defended short-term rental properties with lots of availability. The supply problem is likely to get worse over the coming year, as would-be home sellers with existing, low-rate mortgages segregate to rent their homes out rather than sell into a tough market.

Things do not squint largest on the demand side of the equation. To begin, hospitality occupancy is very sensitive to macroeconomic conditions, and hotel industry insiders are forecasting declines in occupancy and ADR in 2023 in vaticination of a “mild” recession. It is moreover likely that 2021 and early 2022’s no-go run in STR revenues was partly driven by pandemic-era spending and behaviors that aren’t likely to continue.

Qualitatively, by early 2022 the short-term rental sector was getting get-rich-quick vibes as retail investors increasingly gained interest in the space. Articles targeting retired doctors and ultimatum 20% cash-on-cash yields is as tropical to a universal indicator of a peak as they get. There was moreover a growing cottage industry of picks-and-shovels businesses helping others buy and manage STR properties, with unbearable courses on getting rich in short-term rentals that we got lists and aggregators of courses on getting rich in short-term rentals.

No offense to plastic surgeons with a genuine hobbyist interest in hospitality, but a lot of this kind of content popped up on the internet in 2022.

In light of all this, a pullback seems inevitable and will hit publicly-listed companies (e.g., Sonder), privately-held firms (e.g., AvantStay) and retail investors all.

Expanding Multigenerational Living through ADUs

Brad Cartier // Head of Marketing, Hostfully

271%. That’s the increase in people living in a multigenerational household between 2011 and 2021. Further, Freddie Mac found that the share of young borrowers with a co-borrower age 55 has doubled since 1994, spiking in 2021.

Zillow recently found that 18% of recent homebuyers purchased slantingly a friend or relative, and 19% of prospective buyers planned to do the same.

The pandemic velocious the adoption of multigenerational living arrangements: Caregiving is cited as the second most popular reason for multigenerational living, particularly in Hispanic, Asian, and Black households.

With 39% of buyers preferring a home “designed to house the proprietrix as well as a younger generation and an older generation,” many builders are taking notice by offering floor plans geared towards willing multiple generations. Lennar, for instance, offers new homes with self-contained in-law suites.

The benefits of multigenerational living are undeniable: shared budgets, caregiver access, socialization and quality time together, and defended space for everyone.That said, most of our housing stock isn’t designed for this eventuality. The year superiority marks an opportunity for real manor entrepreneurs to get superiority of this (re)emerging trend by towers and renovating with grandma and grandpa in mind.

LETS (QUICKLY) CLOSE THE DEAL

Teresa Grobecker // CEO, Consortia

Lenders want to tropical escrow in 10 days or less. Why, you ask? As I unchangingly say on stage: follow the money. The forfeit of underwriting a loan has ballooned to over $11,000 and lenders are averaging losses of $800 per file.

The largest banks and lenders are raising processes to stop the bleeding.

Given Consortia works with the GSEs (Fannie/Freddie), the Federal Reserve and the largest banks, credit unions and lenders in the country, we have a few confident expectations:

Title: In San Francisco, we waive our title contingencies. Are we crazy and off our rockers? (Yes, but for variegated reasons.) Well-spoken uniting of title can’t be rushed, hence why preliminary title commitments are washed-up surpassing listings go on the MLS. We are worldly-wise to tropical in seven days considering we underwrite the windfall surpassing going on the MLS. The largest banks are like-minded to this process to tropical loans faster.

Appraisal: A handful of the weightier lenders know that Fannie and Freddie are moving toward a 100% data driven valuation system. (NAR plane has a portfolio visitor that helps REALTORS gather this information as a gig-economy job alternative.) This data will be used for valuation waivers and hybrid appraisals, shaving off weeks of the valuation contingency timeline.

And last but not least, money: The Federal Reserve will be ready to settle transactions instantly 24/7/365 starting May 2023. The most reputable banks in the country with the highest SOC2 inspect protocols are part of the rollout. Combine this with the new digital fiat currencies that the major G20 economies are rolling out (the “digital dollar,” as it’s known in the United States), and the United States will have the fastest, most secure real manor purchase money transfer system in the world.

Brokers who prefer these practices will have the competitive wholesomeness to win increasingly listings and tropical transactions faster. As we say at Consortia, slow is smooth, and smooth becomes fast.

PREDICTIONS

ROCKET MORTGAGE ACQUIRES REDFIN

Robert Hahn // Partner, 7DS Associates

With Rocket Companies having an wholesomeness in the mortgage space but at a disadvantage in the home ownership and selling space compared to Zillow, acquiring Redfin would be a way to one-up Zillow.

Rocket Companies is a $16 billion visitor right now. Zillow is well-nigh $8.5 billion. Redfin has fallen from grace and sits at $536 million. Rocket could buy Redfin for mazuma today; Redfin shareholders would likely be interested in a stock swap as well if that were offered. Redfin would requite Rocket Homes an instant presence as a real manor portal. Plus, Rocket Mortgage could move Redfin’s W2 workforce to Rocket Homes to serve as in-house teachers without too much difficulty. There is at least one very good reason for doing that: A W2 employee wage-earner can (as per Glenn Kelman) sell every product the visitor has, including mortgage, without running afoul of RESPA. Zillow can’t do that with its Premier Wage-earner network. Originally published on Notorious ROB.

ZUMPBNB

Matt Michalski // Co-founder, Aryeo

The Airbnb <> Zillow merger has long been talked about. But proptech’s leader will make a splash with flipside Z: Zumper.

Zillbnb meet Zumpbnb.

Airbnb began with short-term stays and has since evolved into stays of any length—just short of “permanent.” Meanwhile, Zumper has emerged as a leader in the long-term rental market, proving to be a formidable foe to the likes of Zillow Rentals and Apartments.com (Costar).

As Airbnb looks to solidify itself as the place to go when you need a stay of any length, associating with a name and visitor that has mastered the long-term market could perpetuate its trademark as the “any stay” company. Zumper, on the other hand, has been experimenting with a Flex Living option and recently spoken an MVP of Zumper Pass—a subscription for booking short-term stays.

Both are titans of their respective corners of the market on a complimentary yet competitive standoff course. My guess is Zumper has a valuation in the $1-$2 billion range, a far cry from the $65 billion market cap of Airbnb today, and certainly within the wheelhouse of the kings of proptech.

Maybe Zumpbnb will be unbearable to hold us over until the days of Zillbnb are upon us.

COSTAR ACQUIRES 3D

Matt Michalski // Co-founder, Aryeo

Costar acquires Matterport as it looks to execute on a similarly scary playbook that it has in commercial. That is, procuring and owning unique listing media to then build a moat between Costar and its competitors. Not only does Matterport possess leading 3D tech, but it owns the unshortened repository of Matterports created in the past year—all of the data within them—and has recently uninventive VHT Studios, the largest real manor photography visitor in the US. Oh, and since Matterport’s 2021 SPAC, its stock is lanugo nearly 90%, leaving it with a market cap of under $1 billion. If I’m Costar, I can’t let this deal slip through the cracks.

OPENDOOR TAKES TO PROPERTY MANAGEMENT

Drew Meyers // Founder, Geek Estate

In a financial pickle, Opendoor acquiring a tech-enabled property management visitor will make too much sense as part of towers its marketplace. In what is now a two-horse race, the well-spoken leader will nab a visitor such as Mynd, Darwin, or Pure to bring a guaranteed revenue generation vehicle in house for all homes on its wastefulness sheet.

CONTECH CENTRAL

Stephen Del Percio // VP & Teammate Unstipulated Counsel, AECOM

Infrastructure snout tailwinds finally propel the US construction industry forward. It’s been over a year since President Biden signed the federal infrastructure snout into law, promising over $500B in new spending on the nation’s roads, bridges, tunnels, ports, and airports over the next five years. But funding has been very slow to roll out and 2022 turned out to be a bit of a tease for us infrastructure nerds. That won’t be the specimen in 2023 – some big projects are on the verge of moving forward (Gateway Tunnel in NYC; the I-75 Brent-Spence Bridge replacement in Cincinnati) with many others in the pipeline. Expect a rented year in the starchy infrastructure space, with plenty of knock-on impacts for stakeholders – from a unfurled brisk industry M&A pipeline to new startups addressing the talent shortage gap and unevolved insurance markets, among many others.

The floodgates unshut in 2023 for renewable energy and EV charging projects in the US. Arguably the renewables space is once there; in 2022, for the first time, wipe energy met over a full day’s demand on electric grids in California and Oklahoma. But in 2023 these types of projects will move into the starchy infrastructure mainstream. We’ll protract to hear increasingly well-nigh construction-related startups in the decarbonization space (which will require trillions of dollars in investment if the world is to reach stat neutrality by the second half of the century). In the US, this will include stat capture and EV charging; companies like Toronto-based SWTCH, which is focused on the multi-family and retail sectors, will grow and expand south of the border. IIJA money will fuel this boom, as will a push for local governments to implement innovative wordage methods to leverage the expertise of the private sector in delivering these sorts of solutions.

The fully voluntary vehicle market shrinks but assisted driving grows. On the heels of Carnegie Mellon-backed Argo.AI shutting lanugo and legacy automakers like Ford reducing their investments in fully voluntary vehicles, 2023 will see other fully voluntary AV projects halt, shrink, or disappear. We’ll hear increasingly well-nigh Apple’s electric car, which won’t be as voluntary as the public expects (or arriving unendingly soon – now rumored to be pushed when to 2026). And assisted driving technologies will play a worthier role in projects that are funded under the IIJA, through companies like Alphabet-backed Cavnue.

Talent shortage forces legacy companies to merge or tech companies to absorb. Not social media but TSMC or Amazon bringing increasingly functions in-house.

A DOUBLING DOWN ON COLLABORATIVE R&D

Dennis Steigerwalt // President, Housing Innovation Alliance

The pace of the homebuilding landscape in 2023 presents a significant opportunity to hoist solutions in overcoming housing supply and affordability issues.

2022 experienced a historically fast and deep waif in housing affordability, and it’s very likely that housing is permanently increasingly expensive. 2020 began with a structural supply gap of virtually 1.5 – 2 million homes. To catch-up to current demand, the industry needs to unhook 1.7 million homes per year through the end of the decade. We nearly achieved this in 2021 with 1.6 million, but fell to 1.5 million in 2022—and experts forecast jus 1.2 and 1.4 million in 2023 and 2024.

In the squatter of the supply-demand gap, we protract to coordinate efforts on shared innovation initiatives. The paradox of cyclical industries investing in innovation is a function of time and money—we’re either too rented to invest or merchantry is too slow to finance it. There are unvarying jabs thrown at the construction industry for its lack of productivity gains and investment into R&D, but that’s unfair. New ideas from top tier talent offer solutions for the industry, and an increasing number of highly visible, upper impact projects are driving homebuilding forward.

We’ll protract to see significant investment in shared R&D withal these pathways in 2023:

- Investments will expand the technology solution spectrum and enhance productivity in home delivery,optimizing project wordage in the field and at the factory. There will be new government investment through programs such as National Science Foundation innovation engines to create robust bio-region economies focused on the future of construction.

- M&A worriedness continues. Fueled in part by domestic mazuma reserves and market-timing, but moreover alimony an eye on foreign wanted flowing from countries with longer investment horizons and leadership teams firmly targeting projects grounded in ESG principles.

- Builders will diamond and unhook prototype homes to demonstrate how we can modernize livability, reduce costs, and minimize the built environment’s footprint on the planet. Merchantry practices to unhook low stat construction will take hold in 2023. In a tight market, builders will win residential projects, and consumers, through this differentiation.

Closing

And, with that, that’s a wrap! Agree or disagree? What are we missing? Leave your thoughts in the comments.

Prior Geek Manor Predictions & Reflections

- Looking Forward to 2022: Climate Takes Center Court // Reflections

- 2021 Predictions // Reflections

- 2020 Predictions // Reflections

- 2019 Predictions // Reflections

- 2018 Predictions // Reflections

- 2017 Predictions // Reflections

The post Looking Forward to 2023: Slow and Steady Wins the Race appeared first on GeekEstate Blog.